Strong interest from buyers indicates that executive condominiums (ECs) are back in vogue in spite of the limp property market.

Developers sold 546 EC units in April, up from the 485 units moved in March and the 126 transacted in April last year, according to the Urban Redevelopment Authority.

Average EC prices rose by 5.4 per cent from 2013 to hit $794 per sq ft in 2014 and added a further 0.3 per cent to reach $797 psf last year – a sign of growing demand, noted Ms Alice Tan, Knight Frank Singapore head of consultancy and research.

Consultants agree that ECs, which are privatised after 10 years, continue to attract buyers as these public-private hybrid homes offer facilities similar to those in condominiums but at a lower price.

Here is a quick guide to buying an EC.

CHECK FOR ELIGIBILITY

A key step is to check for eligibility and obtain approval from the Housing Board.

Prospective buyers cannot have an average gross monthly household income exceeding $14,000 – a ceiling that was raised by the Government last August to make ECs more accessible to a wider pool of people.

They should be first-time flat owners, or have bought only one property under HDB or received one CPF Housing Grant previously. They should not also own property overseas or locally, or have sold any in the past 30 months. Potential buyers should also check if they can get a mortgage.

“Having a comprehensive review of cash outlay in terms of mortgage payments and the impact from future rise in potential interest rates is also essential before deciding on the type of mortgage loan,” said Ms Tan.

VIEW THE PROPERTY, MAKE AN APPLICATION

There is a list of all ECs on sale as well as upcoming launches on HDB’s website. Check this, then make arrangements to view the project site and the showflat.

An application can then be lodged with the developer, which can offer units via computer balloting or walk-in selection, according to the HDB website.

MAKE PAYMENTS FOR THE EC

Successful applicants will be invited by the developer to book an EC and sign the Option to Purchase (OTP) form. They can also submit an application form for a CPF Housing Grant to the developer.

All buyers, including those paying in cash, also have to pay a 5 per cent option fee.

The applicant then has to sign a Sale and Purchase Agreement, which includes a Letter of Offer if a bank is providing a loan.

Applicants also have to pay 15 per cent of the purchase price along with 1 per cent to 3 per cent legal and stamp fees, using either CPF money or cash, within nine weeks from the date of the OTP or the signing of the Sale and Purchase Agreement.

COLLECT KEYS

Homebuyers can collect the keys when the EC is completed.

It is important to note that buyers must occupy the EC for five years before it can be sold on the open market.

LOCATION, LOCATION, LOCATION

Mr Ong Teck Hui, national director of research and consultancy at JLL, noted that ECs with good transportation connectivity tend to be in demand, as well as those near amenities such as schools, shopping facilities and other conveniences.

“However, pricing for such developments tend to be a bit stiffer, although they would be better long-term investments,” he said.

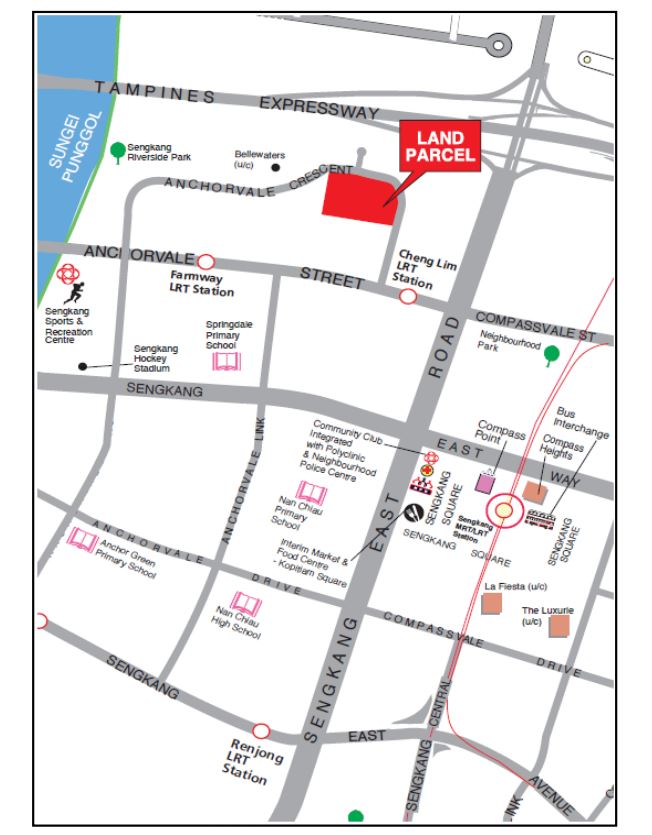

Mr Ong noted that possible EC launches for the rest of this year include Treasure Crest in Anchorvale Crescent, Northwave in Woodlands Avenue 12, and the parcel in Choa Chu Kang Avenue 5, which will likely offer 1,400 to 1,500 units.

It is also important to consider the experience of the developer, added Ms Tan. “ECs that are built by reputable developers with a good track record in quality construction could be a better bet in terms of ensuring sustainability and quality of an EC home.”

HOME OR INVESTMENT?

For genuine home-hunters, ECs can be a “worthwhile” buy, said Dr Lee Nai Jia, regional head of South-east Asia research at DTZ.

“They have the option of selling it five or 10 years later and, even if the price doesn’t go up much, they still gain from the various subsidies available for ECs,” he said, adding that most buyers, for instance, tend to make use of the CPF Housing Grant instead of paying cash.

Dr Lee added that those looking at ECs as a form of investment, however, should be aware of the various restrictions on subletting as well as the possible implications of higher interest rates.