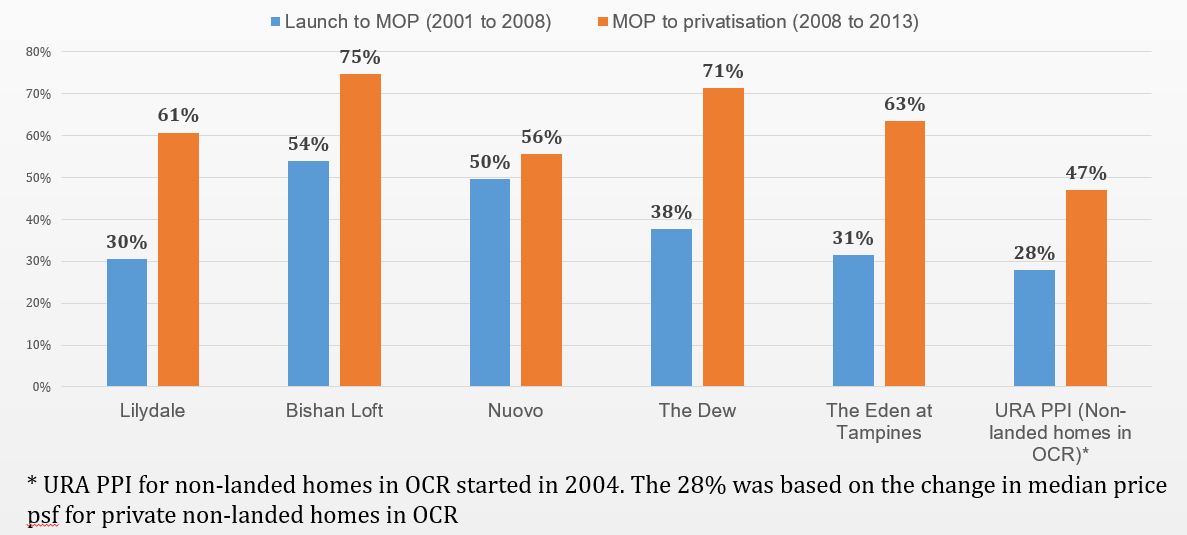

Executive condominiums, a hybrid of private and public housing, have been perceived as a low-cost, high-return investment asset. This is not a baseless proposition. Most of us are aware that new ECs are typically priced at a 20% to 30% discount to private condos of similar attributes. Furthermore, they will attain condo status 10 years after they are completed. Intuitively, EC prices would catch up with condo prices towards privatisation, which underscores their value proposition.

The most notable example is Bishan Loft EC, which was launched in 2001. Prices increased 157% from $422 psf at launch to $1,084 psf this year. The project outperformed the URA price index for private non-landed homes, which trended up 56% over the same period. It also outshines Rafflesia Condominium in terms of price performance. Prices at Rafflesia Condominium appreciated 37% from $760 psf at launch to $1,043 psf this year. Located on Bishan Street 21, the condo is less than 400m from the Marymount MRT station and a stone’s throw from Raffles Institution.

The example is not unique to Bishan. Prices of ECs in less stellar locations have also rallied ahead of private condos. Take The Quintet EC in Choa Chu Kang, which was launched in 2003 at an average price of $367 psf. Prices have increased 110% to an average of $769 psf this year. In comparison, prices at The Warren, also in Choa Chu Kang, increased 76% from $445 psf to $781 psf over the same period. The Warren and The Quintet were completed in 2004 and 2006, respectively.

A foolproof investment asset?

In the past few months, some market watchers have vouched for ECs as a foolproof investment asset that offers superior investment returns compared with private condos. This is true for owner-occupiers because ECs are heavily discounted to private condos of comparable age in their vicinity, giving homebuyers a head start in the race for capital appreciation.

However, the downside of buying ECs is the resale and subletting restriction during the five-year minimum occupation period that may cause home owners to miss out value deals in the market. Home owners also lose the flexibility of renting the property should the need arise. Assuming a net rental yield of 2.5% to 3% for private mass-market condos, the subletting restriction would result in a cumulative 13% to 15% loss in rental yields over five years. Together with a construction period of three years, EC buyers may have to wait up to eight years to unlock the value of their properties. The upfront discount, therefore, serves to compensate for these restrictions.

It is also worth noting that EC prices are somehow still 2% to 5% lower than those of comparable condos even after they are fully privatised, with the exception of Bishan Loft EC. Units at The Quintet EC, for example, fetched $769 psf on average in 2016, 2% shy of the $781 psf transacted at The Warren. Similarly, units at Park Green EC in Sengkang changed hands at $718 psf this year, 4% below the $747 psf average price at Rio Vista in Hougang. Both developments were completed in 2004, although there could be micro-locational forces at play that cause the difference in their prices. One possible explanation is that private condos are perceived to offer better-quality products and finishes. However, this is subjective considering that recent EC developers have upped their game with thematic concepts, strong facilities and smart-home features.

Tipping the balance with location

The price appreciation for private condos near an MRT station may be more significant than that of ECs in their vicinity. This is evidenced by The Jade, which is located next to the Bukit Batok MRT station and West Mall. Prices appreciated at the same pace as those for The Dew EC on Bukit Batok Street 21 between their launch dates and 2016.

Separately, well-located old condos present an alternative buying opportunity. They are cheaper than new condos in their vicinity and prices could be on a par with new ECs. Most of us are familiar with the 1,006-unit Mandarin Garden Condominium on Siglap Road, which is one of the oldest condos in Singapore. Two 1,572 sq ft units on the low floors were transacted at an average price of $353 psf in 2001. Prices have since more than doubled to $834 psf, based on comparable transactions in 2016. The entry price of $353 psf and the 136% capital appreciation are not inferior to those of ECs that were launched in 2001, including Nuovo EC in Ang Mo Kio, The Dew EC in Bukit Batok and The Eden at Tampines EC. At the same time, the properties are not subject to the various restrictions associated with public housing. However, buyers must put up with an obsolete design and higher maintenance cost owing to wear and tear over the years.

Not all old condos offer a better investment proposition than ECs. Units at Elias Green in Pasir Ris, for example, were transacted at an average price of $357 psf in 2001. Prices have since appreciated just 60% to $572 psf this year.

Deal or no deal?

For owner-occupiers, first-hand ECs clearly offer an excellent arbitrage opportunity and the price appreciation is more pronounced after privatisation.

Price performance of ECs launched in 2001

On the other hand, if the flexibility of selling and renting the unit is important, potential buyers may consider alternative assets such as older condos and new condos that are competitively priced. High Park Residences, for example, was launched in July 2015 at $989 psf. If such a deal exists in the market and affordability is not an issue, a homebuyer would be faced with equally attractive options between an EC and a private condo of the same league. However, there are limited choices in the market. The developer of High Park Residences paid less than $450 psf ppr for the land parcel in 2014. Since then, there have not been any sites that have fetched a price lower than that. As at June, there were only 37 unsold units in the project.

To maximise financial returns, homebuyers should look for ECs that offer higher discounts to nearby condos as well as those located near a transit node or growth corridor. Entry price has proved to be as important as location. Bishan Loft EC was launched at a 44% discount to Rafflesia Condominium, which was rolled out just one year earlier. Although we do not account for any factors that might contribute to the price difference, the significant gap in their launch prices would have a bearing on the investment returns for homebuyers.

Treasure Crest EC in Sengkang and Northwave EC in Woodlands are currently the most competitively priced new ECs in the market if we do not factor in the resale levy exemption and other forms of rebates offered at other projects. Their respective developers, Sim Lian Group and Hao Yuan Investment, paid about $280 psf ppr for the two sites in 2015, the lowest price for EC land since July 2011.

While private condos are perceived to offer better-quality products and finishes, some ECs are courting buyers with novel facilities and services that put them closer to private condos in terms of product offerings. Westwood Residences EC in Jurong, for example, is the first bicycle-themed development in Singapore that comes with a sheltered bicycle garage and designated bike maintenance area. Qingjian Realty positions The Visionaire EC as the next-generation smart home. Its smart-home apps let homeowners control the digital lock that allows access to the house as well as appliances, from air conditioners and water heaters to washing machines and refrigerators.

Source: http://www.theedgeproperty.com.sg/content/executive-condos-real-deal-or-just-hype