The authorities have weighed in on the issue of e-applications for executive condominiums (ECs), saying that developers of ECs are not allowed to offer incentives to buyers who have not booked units.

Developers are also required to engage independent auditors to audit their sale processes to ensure they fulfil their obligations.

A spokeswoman for the Housing & Development Board (HDB) said: “The Ministry of National Development (MND) and the HDB take a serious view of any malpractice by developers. Any feedback on malpractice by EC developers or their marketing agents is fully investigated. The authorities will not hesitate to take action against errant parties.”

HDB added that while EC developers may decide on the mode of sale and engage marketing agents to handle the process, they must comply with the Conditions of Tender and the Building Agreement to conduct the sale of EC units fairly and transparently.

These comments to The Business Times follow the newspaper’s recent study of EC projects launched since 2014, which had showed poor sales in many EC projects – contrary to the strong e-application numbers that developers claimed to have received.

During their launch weekend, half the 14 EC projects fell short of a 20 per cent conversion rate – that is, the number of e-applicants who went on to buy a unit. This 20 per cent was at the lower end of what most industry players deem reasonable in today’s market.

Nine projects were over-subscribed for their available units; three others were almost fully subscribed during the e-application stage.

Some industry players warn of a potential supply overhang of ECs in the short-term, particularly for projects launched back to back in the same area; such projects end up vying for the same pool of eligible buyers and may have overlaps in e-applicants.

But market talk has been rife about e-application numbers being bumped up to create an impression of high demand; some developers were said to have offered agents supermarket or cash vouchers to incentivise e-applications. There have also been unverified tales of e-applications from earlier EC projects being used for subsequent ones, and agents signing up friends or relatives as e-applicants.

As expressions of interest without cost or obligation, e-applications do not require buyers to submit documents showing their eligibility. But developers have wasted little time trumpeting strong e-application numbers to the press ahead of booking day.

ECs are public-private hybrids with initial-buyer eligibility and resale restrictions, which are fully lifted a decade after the completion of the project. The government awards EC land parcels through public tenders to private developers, who undertake the development and sale of the ECs to eligible buyers.

The HDB spokeswoman said that under the Executive Condominium Housing Scheme (Eligibility) Regulations, an “applicant” refers to any person who has applied to buy an EC, including e-applicants.

“For e-applications, there are built-in checks in the system to ensure that applicants meet the eligibility criteria,” she said. “While developers are in charge of managing and processing the applications, the HDB also counter-checks the income and supporting documents subsequently submitted by the buyers to verify that they meet the eligibility criteria.”

Applicants may not go on to book a unit for a variety of reasons. For instance, the units they want may not be available by the time their turn is due, or checks reveal that they have fallen short of the eligibility criteria.

At the pre-launch briefings typically held for developers of upcoming EC projects, the HDB has lately reminded developers to ensure that the e-applicants are eligible for this class of housing and have genuine buying interest.

Two EC projects are slated to begin their e-application this month or the next, namely Hao Yuan’s Northwave in Woodlands and Sim Lian’s Treasure Crest in Anchorvale Crescent.

A spokesman for Hao Yuan told BT that the 358-unit Northwave will conduct its e-applications “in a manner that complies with the Executive Condominium Housing Scheme Act”, and that it will require e-applicants to submit their personal documents so that their identities, relationship and income level can be assessed for eligibility.

“The e-application will culminate in a balloting exercise, overseen and witnessed by external auditors on-site, which will determine the order these successful applicants get to select their units for purchase.

“We will not be providing potential buyers with gift incentives for e-applications, although we might extend discounts and/or freebies to eligible e-applicants when they eventually decide to buy a unit.”

Sim Lian group executive director Kuik Sing Beng said the group has not incentivised marketing agents for e-applications in the past.

“That’s why our conversion rates have been high,” he added.

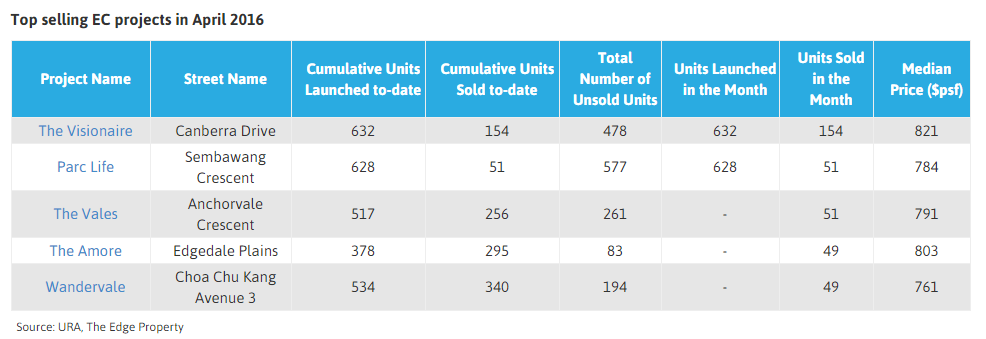

Its Wandervale EC project in Choa Chu Kang hit a 33 per cent conversion rate on e-applications; the take-up rate on available units during its March launch weekend was 49 per cent.

E-application for the 504-unit Treasure Crest is to start in early July.

But some industry players observed the lack of clear boundaries for pre-sales marketing of EC projects.

ERA Realty key executive officer Eugene Lim said: “It would be useful for HDB to set up clear guidelines for developers so that they can follow them in the spirit of fair play and transparency.”

At the end of the day, it is the conversion rates that matter, he added.

But Century 21 Singapore chief executive Ku Swee Yong said that fairness and transparency in the conduct of EC sales can be compromised if genuine investors feel pressured by media releases of high subscription rates and the crowds in the showflats.

“I think that e-applications should all be vetted, and only qualified buyers being allowed to get balloting numbers. If we make sure that all e-applicants are qualified buyers, the conversion rates will be much higher.”

Earlier this month, the Controller of Housing issued a circular to licensed housing developers, reminding them to comply with the rules when offering any incentive scheme to buyers of private residential properties.

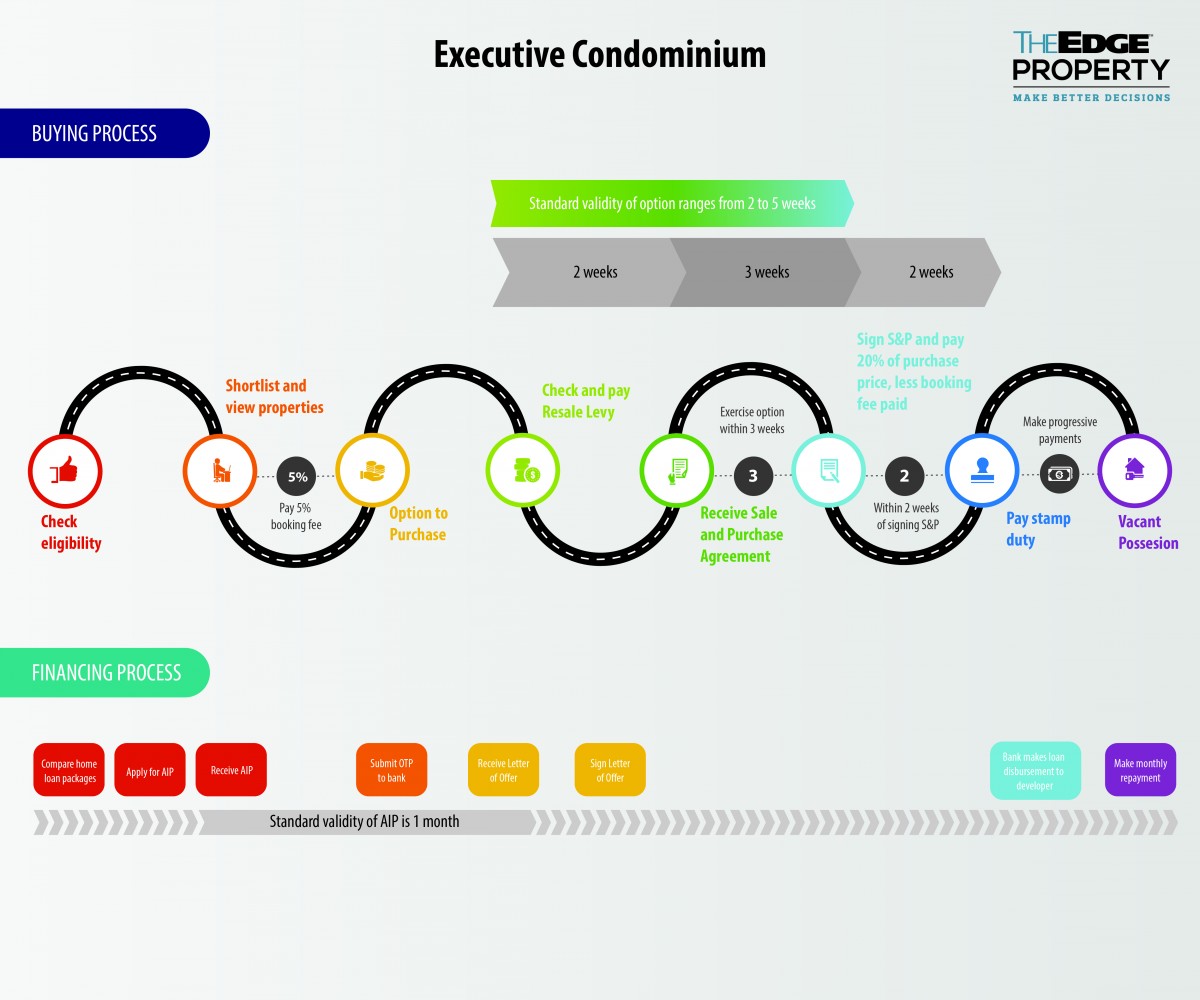

Developers were reminded, among other things, not to offer any incentive to buyers before the exercise of the option to purchase, if such incentives circumvent the requirement for buyers to pay the minimum booking fee.

This came on the heels of creative incentives by developers to move units. Among them was the “specimen cheque scheme” introduced by the joint developers of GEM Residences, which offered potential buyers cheques of S$7,500 or S$10,000.

These potential buyers, who used these cheques for their expressions of interest, were told that the cheques would be used to offset the booking fees on balloting day. But the developers were later directed by the Controller of Housing not to proceed with the use of these 2,500 cheques because the scheme goes against the requirement of a minimum 5 per cent booking fee when buying a home.

This article was first published on Jun 22, 2016 by The Business Times