EXECUTIVE condominiums (ECs) were originally conceived to cater to the aspirations and needs of the so-called “sandwiched” class – those whose household income exceed the ceiling for public housing, but are not yet able to comfortably afford a private condominium.

Currently, the monthly household income ceiling to qualify for an EC purchase is set at S$14,000, versus S$12,000 for those purchasing the Housing and Development Board’s (HDB) build-to-order (BTO) flats.

Over the years, 60 ECs have been successfully launched. To date, 42 of them have been completed. Currently, 18 projects still have units available for sale in the market.

In recent years, the government has ramped up the housing supply. The HDB has released around 20,000 flats annually for sale since 2011.

This year, the figure is expected to be slightly lower, at around 18,000 new flats. Similarly, the supply of private condominiums has also been abundant. As at Q2 2016, there were 23,282 unsold private residential units coming from projects that have obtained planning approvals.

For a buyer with a monthly household income of up to S$14,000, purchasing a mass market private condominium is not out of the question, while those in the lower income bracket can easily take the HDB BTO route. Thus, amid the plentiful choices that a buyer has, are ECs still a relevant scheme in today’s market?

Steady demand for ECs

As an asset class targeted at the “sandwiched” category of buyers, ECs come with qualifying buyer eligibility criteria that are similar to public housing.

Buyers are also subject to resale restrictions that are partially lifted five years after the project’s completion. This means they can only resell to Singaporeans or Singapore permanent resident (SPR) buyers after the first five years. These resale restrictions are fully lifted 10 years after the project’s completion.

Besides satisfying the monthly household income criterion of not exceeding S$14,000, applicants must purchase an EC either by forming a family nucleus or with other singles if they are at least 35 years old.

Only Singaporean couples and Singaporean/SPR couples may purchase an EC unit. Also, buyers have to fulfil a mandatory five-year minimum occupation period (MOP) before they are allowed to rent out the whole unit or sell off the apartment.

Despite these restrictions, ECs come with a full suite of condominium facilities and are physically indistinguishable from private condominiums in design and physical outlook.

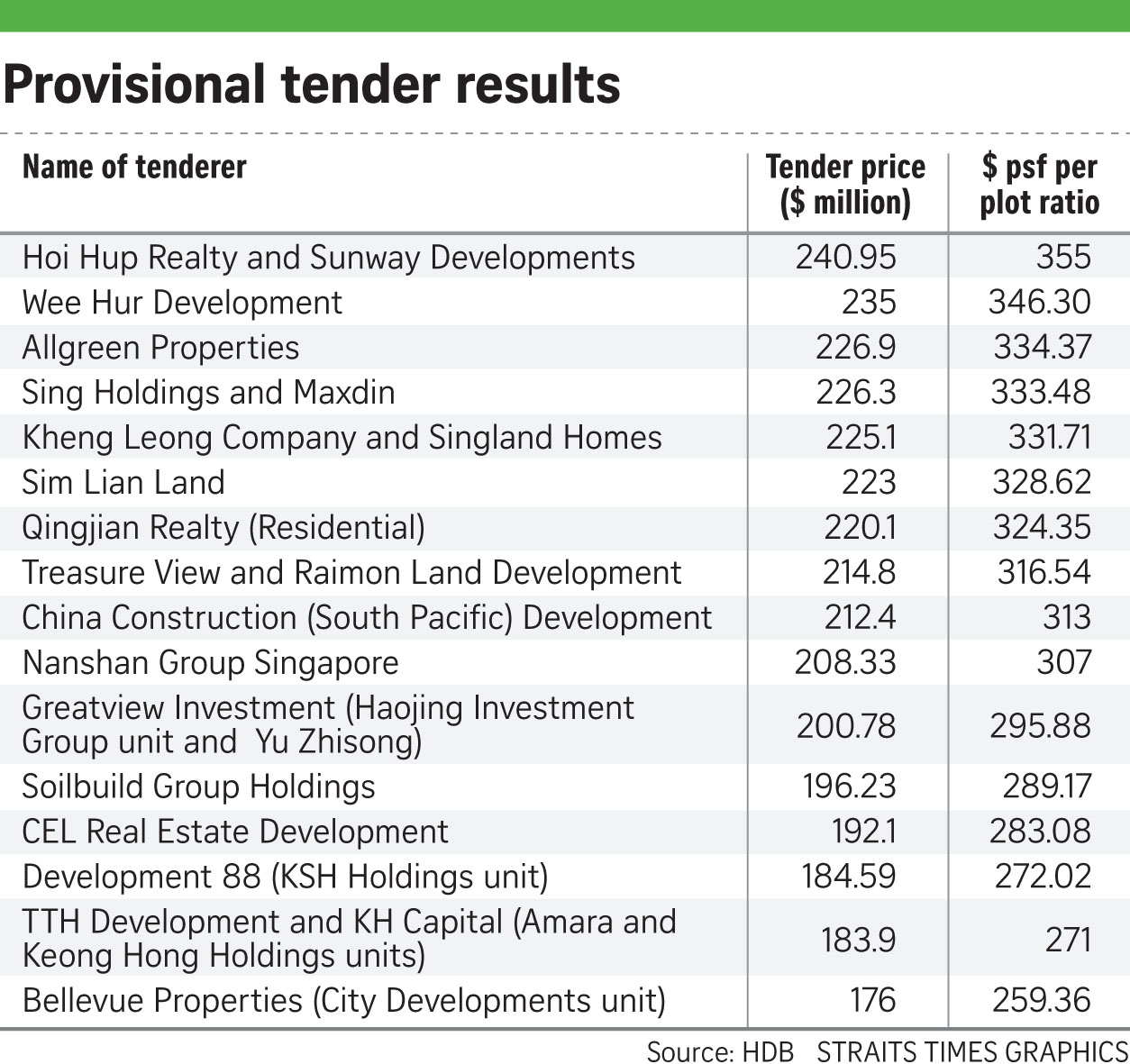

In the recently concluded land tender for the EC site at Anchorvale Lane, located next to Punggol Reservoir and near the Sengkang Riverside Park, there were a total of 16 bids put in by developers.

The plot, which can yield about 630 units, attracted the highest number of bidders for an EC site since the Yuan Ching Road site (now Lake Life EC) in July 2013.

Land hungry developers are optimistic about the outlook for ECs and expect the market to be able to soak up most of the remaining available units by the time they are ready to launch the project in late 2017 or early 2018.

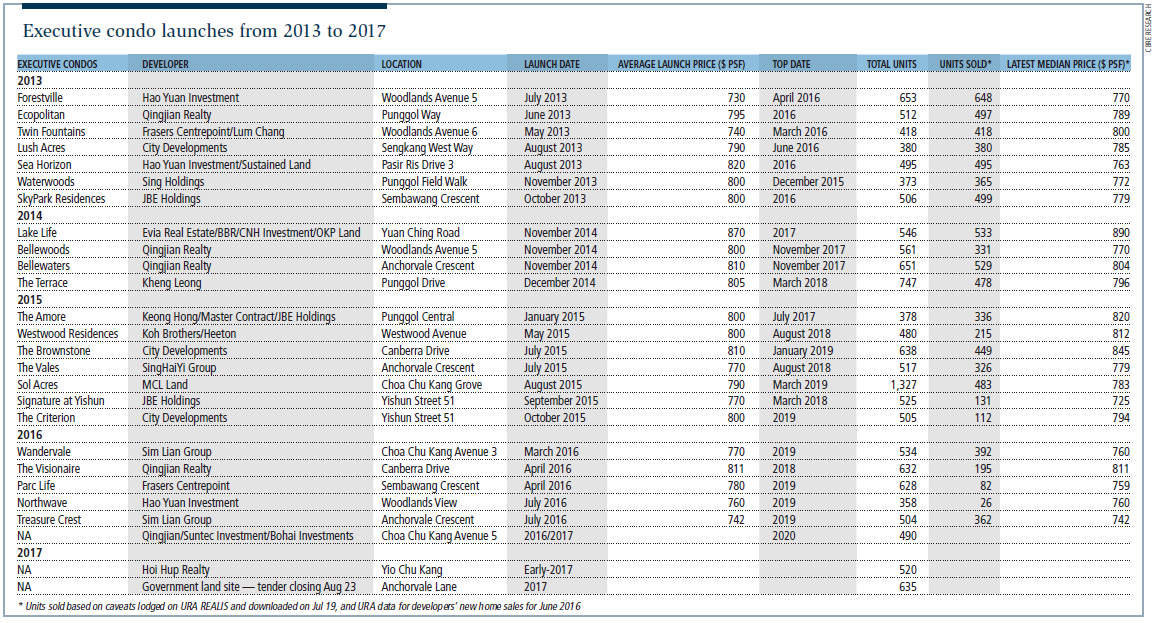

So far in 2016, we have seen good and steady demand for ECs. According to data from the Urban Redevelopment Authority (URA), for the first seven months of 2016, 2,697 EC units were sold by developers. This has already surpassed the total 2,550 units they sold during the whole of 2015.

In addition, some of the best-selling projects this year have been ECs. Wandervale and Treasure Crest were two of the most successful EC launches since 2014.

Wandervale, the first EC to launch in 2016, sold some 50 per cent of its 534 units on the opening weekend, while in July, Treasure Crest sold some 72 per cent of its 504 units in the first weekend.

Existing EC projects have also been seeing sustained interest from buyers, with developments such as Bellewaters, The Vales and The Terrace seeing a steady stream of buyers even though they are not new launches.

Evidently, despite competition from mass market condominiums and public housing, ECs are still proving to be a practical and popular choice among buyers. While the pace of sales for some EC projects are faster than others, it is important to note that even for the EC projects that do not do as well initially, they do see a steady and sustained pace of sales over the development period, such that by the time the Temporary Occupation Permit (TOP) for the project is obtained, the majority of the units would have found buyers.

Rational, practical buyers

Typical EC buyers are either first-timers buying their matrimonial home, or families with young or teenage children that are upgrading from HDB flats.

They are buying for owner-occupation and not with the immediate intention to rent it out, as this option is only open to them after the first five years of occupation.

So these buyers behave very rationally and rarely buy on impulse. While some jostle with other buyers for choice units during the initial launch, others commit to their purchase only after they have made their rounds and have thoroughly researched the market.

For most EC buyers, the main appeal of ECs is the condominium address and lifestyle but at a cheaper price. ECs are typically priced at S$750 to S$850 per square foot (psf), while mass market condominiums within the vicinity are likely to be S$1,000 to S$1,100 psf onwards.

This puts the EC buyer on an immediate price advantage as he is essentially buying a product that has a similar look and feel of a mass market condominium at a cheaper price.

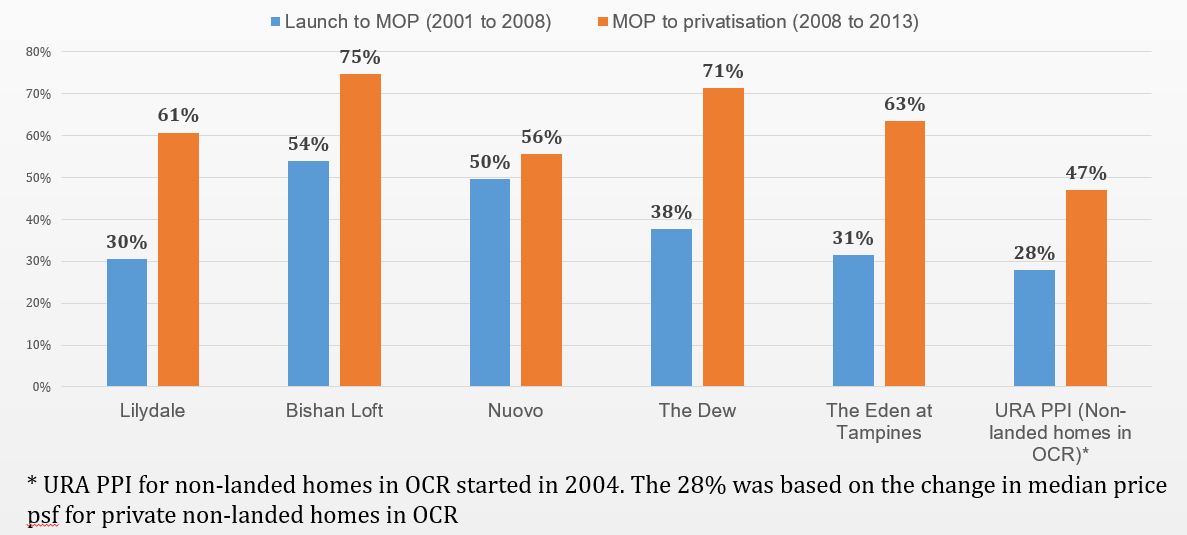

After 10 years from completion, the EC unit can also be sold to foreign purchasers. So, depending on the state of the market at the relevant point in time, the EC buyer may enjoy a larger capital gain compared to someone who had bought a mass market condominium unit at around the same time as the EC buyer.

Furthermore, eligible first-time EC buyers have the added advantage of using the CPF Housing Grant of S$30,000 to help pay for the purchase price. There are no housing grants available for private condominiums.

The second reason is a practical one. EC buyers are owner-occupiers and they are usually purchasing the unit to start a family.

The majority of EC projects offer mainly three and four-bedroom units, with the exception of some that may have a small selection of one and two-bedroom units.

In comparison, a mass market condominium may have more smaller-sized units than larger units as they also target the investor buyers who prefer a lower price quantum.

If so, the living environment becomes quite different when you compare an EC with a mass market condominium. In an EC environment, you are likely to find that the majority of residents are local families (of around the same age group) with children, while in a private condominium, it is likely to be quite diverse.

The third reason is the living space. Size matters when you have to house a family. Treasure Crest EC’s three-bedroom units measure 958 to 1,249 square feet, while its four-bedroom units are 1,345 square feet. Comparatively, a private condominium’s three-bedroom units may be about 880 to 1,100 square feet and their four-bedrooms may not exceed 1,300 square feet.

A matter of choice

A buyer who is eligible to buy an EC could also choose to stay in public housing, which is more affordable. Alternatively, private housing is also a viable option, albeit a more expensive one which may require taking up more debt for a longer period.

Whatever the choice, there is no “correct” housing type to buy. It all depends on the buyer’s preference, financial ability and household needs.

Ultimately, by introducing ECs into the market, the government is providing buyers with another housing option. With more variety in the market, buyers can then choose the type of housing that best suits their needs, rather than be limited to only public or private housing.

Herein lies the relevance of ECs.

Source: http://www.businesstimes.com.sg/hub/property-2016/ecs-still-popular-among-the-sandwiched-class